US Dollar Looks to Break Above 103.7 Ahead of Fed Decision — Key Levels to Watch

- The upcoming Fed meeting takes center stage as global markets monitor geopolitical risks.

- Meanwhile, the US dollar has continued moving up and is now testing a key resistance ahead of the Fed decision.

- Technical analysis reveals a resistance test around 103.7; a hawkish stance could propel the dollar index toward 104.4.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

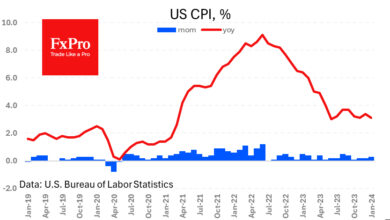

The Fed’s monetary policy meeting this week is being closely watched by global markets as macroeconomic data keeps undermining the need for the US central bank to start lowering rates in the first semester of the year already.

Meanwhile, geopolitical risks remain at a high, bringing more volatility to currency markets.

But despite the backdrop, the dollar index remained stable last week, maintaining the positive trajectory since the beginning of the year.

Fundamental Factors

The dollar traded cautiously against six major currencies, with downward pressure easing slightly after US GDP data for the fourth quarter surpassed expectations at 3.3%.

The market remains vigilant for signals from the upcoming Fed meeting on Wednesday, with sustaining resistance in the dollar index at an average of 103.7.

Supported by robust US growth data and positive economic indicators, the greenback continues to demonstrate strong performance against currencies of developed nations in the first month of the year.

While the Fed’s current outlook is reassuring, there is a growing consensus that there will be no rush for expected interest rate cuts, challenging recent market expectations.

Market commentators highlight potential factors strengthening the dollar’s trend, including the chance of deviating from the Fed’s 2% inflation target due to a thriving economy and the bank’s commitment to maintaining a tight monetary policy.

Conversely, any signs of a deteriorating economic outlook in other developed markets could further bolster the dollar, as higher interest rates pose a greater risk of recession for these regions compared to the current situation.

Technical Levels to Monitor

DXY Price Chart

DXY Price Chart

From a technical standpoint, the DXY has been testing a resistance line around 103.7 since last week as part of its recovery process.

Although sales from the short-term resistance level last week pushed the index down to the 102 range, the dollar has started to approach the resistance zone again after finding support from US growth data.

This week, the DXY is expected to pivot around the 103.5 level, with potential increased volatility depending on the messages conveyed by the Fed after the interest rate decision.

A hawkish decision from the Fed would support the dollar, potentially allowing the dollar index to continue its upward trajectory above the 103.7 level towards the next resistance line at the 104.4 level.

In the case of a more moderate view, the 103 level could serve as a significant support level for short-term consolidation.

A potential retracement might bring the index back towards the 102 support from the first week of January, and during such a pullback, an acceleration of inflows into risky markets may be observed.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship «Tech Titans,» which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Claim Your Discount Today!

Claim Your Discount Today!

Disclaimer: