Are We in the Midst of a Stock Market Bubble?

I received an email this past week concerning George Soros’

It’s an interesting question, and I have previously written about the

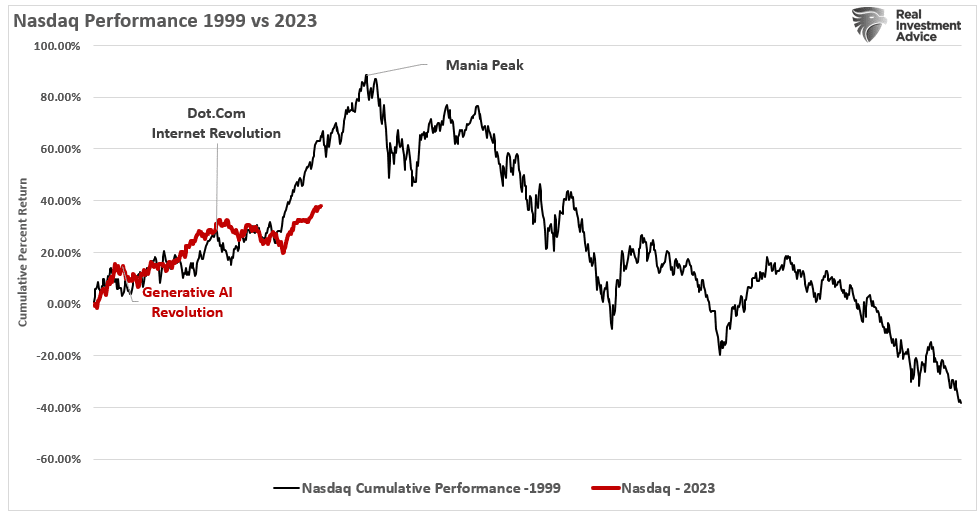

Notably, this theory begins to resurface whenever markets become exuberant. However, concerning the email, there seems to be a similarity between the current driven speculation and what was seen in the late 90s.

Nasdaq Performance 1999 vs 2023

Nasdaq Performance 1999 vs 2023

There is, of course, a significant difference between the companies surging higher today versus those in the late 90s.

That difference is that those companies involved in the “A.I.” race have revenues and earnings versus many Dot.com darlings that didn’t.

Nonetheless, the valuations paid for many companies today, in terms of price-to-sales, are certainly not justifiable.

The table below shows all the companies in the S&P 500 index with a price-to-sales ratio above 10x. Do you recognize any you own?

S&P 500 with PS above 10x

S&P 500 with PS above 10x

I picked 10x price-to-sales because of what Scott McNeely, then CEO of Sun Microsystems, said in a circa 1999 interview.

t

This is an important point. At a Price-to-Sales ratio of TWO (2), a company needs to grow sales by roughly 20% annually.

That growth rate will only maintain a normalized price appreciation required to maintain that ratio. At 10x sales, the sales growth rate needed to maintain that valuation is astronomical.

While 41 companies in the S&P 500 are trading above 10x price-to-sales, 131 companies trade above 5x sales and must grow sales by more than 100% yearly to maintain that valuation.

The problem is that some companies, like Apple (NASDAQ:AAPL), have declining revenue growth rates. Apple Inc vs S&P 500 Composite Market ETF

Apple Inc vs S&P 500 Composite Market ETF

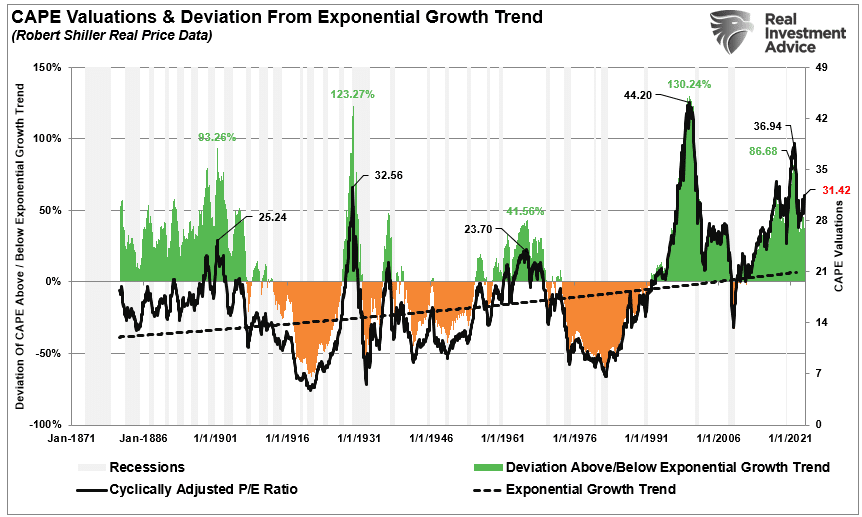

While it is believed that “A.I.” is a game changer, this is not the first time we have seen such a in the markets. S&P 500 Index Vs CAPE Valuations

S&P 500 Index Vs CAPE Valuations

As shown, there is an end to these cycles, as valuations ultimately matter.

So, what does this have to do with the

The “Theory Of Reflexivity” – A Rudimentary Theory Of Bubbles

For investors, in the ,” silly notions like and matter very little.

Such is because, in the very short term, all that matters is momentum. However, over extended periods, valuations are a direct determinant of returns.

Despite one selloff after another leading to increased volatility, the markets are currently hitting all-time highs as the speculative chase for return heats up.

However, the current market mentality reminds me much of what Alan Greenspan said about this behavior.

Once again, investors accept a low equity risk premium for market exposure.  Equity Risk Premium vs S&P 500

Equity Risk Premium vs S&P 500

Such brings us to George Soros’

The chart below is an example of asymmetric bubbles.

Asymmetric Bubbles

Asymmetric Bubbles

Soros’ view on the pattern of bubbles is interesting because it changes the argument from a fundamental to a technical view. Let me explain.

Bubbles And Exuberance

Prices reflect the psychology of the market, which can create a feedback loop between the markets and fundamentals. As Soros stated:

The chart below utilizes Dr. Robert Shiller’s stock market data going back to 1900 on an inflation-adjusted basis.

I then looked at the markets before each significant market correction and overlaid the asymmetrical bubble shape, as discussed by George Soros.

Asymetric Bubbles-S&P 500

Asymetric Bubbles-S&P 500

Of course, what each of those previous periods had in common were three things:

The S&P 500 trades in the upper 90% of its historical valuation levels.

Valuations Deviation From Long-Term Growth Trend

Valuations Deviation From Long-Term Growth Trend

However, since stock market reflect valuations only reflect those emotions.

As such, price becomes more reflective of psychology. From a the level of is on full display as the S&P 500 trades at one of the most significant deviations on record from its long-term exponential trend.

S&P 500 Deviations From Growth Trend-1900-Present

S&P 500 Deviations From Growth Trend-1900-Present

Historically, all market crashes have resulted from things unrelated to valuation levels.

Issues such as liquidity, government actions, monetary policy mistakes, recessions, or inflationary spikes are the culprits that trigger the

Notably, the and are never the same.

Comparing the current market to any previous period is rather pointless. Is the current market like 1995, 1999, or 2007? No. Valuations, economics, drivers, etc., all differ from one cycle to the next.

Critically, the financial markets adapt to the cause of the previous However, that adaptation won’t prevent the next one.

Conclusion

There is currently much debate about the health of financial markets. Can prices remain detached from the fundamentals long enough for the economic/earnings recession to catch up with prices?

Maybe. It has just never happened.

The speculative appetite for fostered by the Fed’s ongoing interventions and suppressed interest rates, remains a powerful force in the short term.

Furthermore, investors have now been successfully “ by the markets to for

The speculative risks and excess leverage increase leave the markets vulnerable to a sizable correction. The only missing ingredient for such a correction is the catalyst that starts the

It is all reminiscent of the 1929 market peak when Dr. Irving Fisher uttered his famous words:

The clamoring of voices proclaiming the bull market still has plenty of room to run tells the same story.

History is replete with market crashes that occurred just as the mainstream belief made heretics out of anyone who dared to contradict the bullish bias.

When will Soros’ affect the market? No one knows with any certainty. But what we do know with certainty is that markets are affected by gravity. Eventually, for whatever reason, what goes up will come down.

Make sure to manage your portfolio risk accordingly.