¿Podrá Nvidia mantener su racha de ingresos de 2.000 millones de dólares?

Ayer recibimos el informe de confianza de los consumidores del Conference Board, que muestra que las expectativas de inflación a un año aumentaron hasta el 6% frente al 5,2% de enero. Esto ocurre tras el informe de la Universidad de Michigan, que se disparó desde el 3,3% al 4,3%. No sé qué mostrarán los datos del mes que viene, pero parece claro que la inflación está haciendo cualquier cosa menos moderarse. Ciertamente, se podría argumentar que las expectativas de inflación ya no están bien ancladas.

-

¿Cómo invertir con éxito en la temporada de resultados empresariales? Averígüelo con InvestingPro: ¡Por menos de 9 euros al mes! Haga clic aquí y revise las métricas clave como el Valor Razonable asignado a partir de más de una decena de modelos financieros, la salud financiera de la empresa y las perspectivas de los analistas.

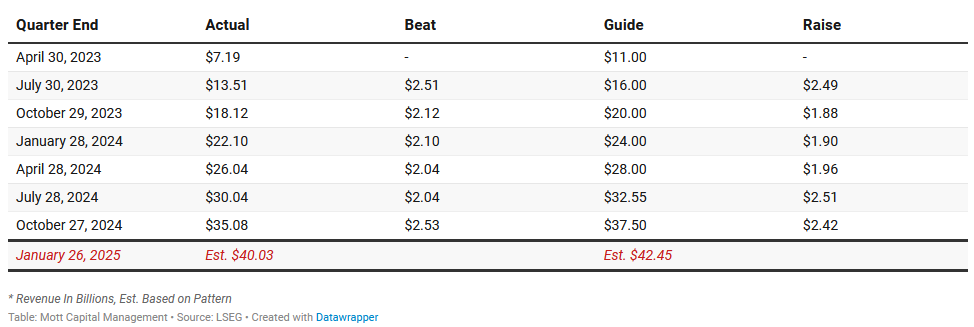

Pero olvidémonos de la inflación por ahora, porque tenemos asuntos más urgentes entre manos, a saber, las acciones más importantes del mundo, las de Nvidia (NASDAQ:NVDA), y su informe de resultados de hoy. Preveo que los ingresos superarán los 2.000 millones de dólares, seguidos de una previsión para el próximo trimestre que los supere en otros 2.000 millones de dólares, es decir, un total de 4.000 millones de dólares más que la previsión del trimestre pasado para el trimestre actual. Al fin y al cabo, es lo que llevan haciendo seis trimestres consecutivos, así que ¿por qué no iban a ser siete? No sería de extrañar que los ingresos de la empresa superasen los 40.000 millones de dólares y que las previsiones superasen los 42.500 millones.

La pauta de Nvidia es superar y aumentar los ingresos

Nvidia’a Pattern of Revenue Beats And Raises

Nvidia’a Pattern of Revenue Beats And Raises

En estos momentos, todo apunta a que las acciones se muevan sólo un 9% tras los resultados, lo que supone una oscilación de la capitalización de mercado de 300.000 millones de dólares en cualquier dirección. ¿Qué podría salir mal? Las opciones en-el-dinero que vencen el viernes presentan una volatilidad implícita de alrededor del 147%, y es probable que aumente aún más hoy.

En estos momentos, las opciones de compra de 127 dólares para el viernes cotizan a 6,60 dólares, lo que significa que las acciones tienen que subir hasta 133,60 dólares —alrededor del 5%— sólo para que el comprador alcance el punto de equilibrio. Mientras tanto, las opciones de venta de 127 dólares para el viernes cotizan a 6,90 dólares, lo que significa que Nvidia debería caer hasta 120,10 dólares, o un 5,4%, para alcanzar el punto de equilibrio. Supongo que habrá muchos titulares descontentos de opciones de compra y de venta por la mañana.

- ¿Le gustaría saber cómo organizan sus carteras los inversores con más éxito? InvestingPro le da acceso a las estrategias y carteras de los mejores inversores. Además, recibirá cada mes más de 100 recomendaciones de valores basadas en análisis respaldados por IA. ¿Siente curiosidad? Haga clic aquí para obtener más información.